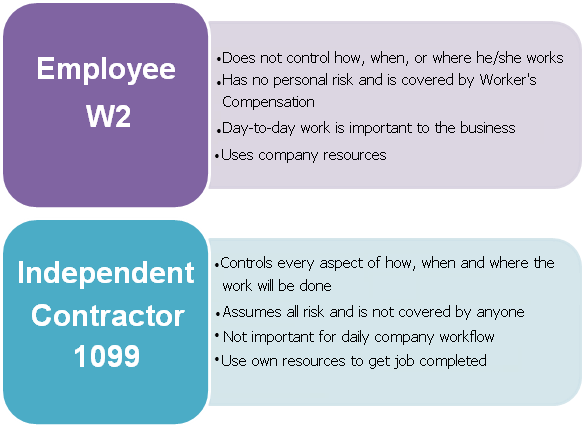

Employee or Contractor? One of the largest expenses in your nonprofit is payroll and all that goes with it. In addition to payroll, you also have to pay payroll taxes, unemployment, leave, insurance benefits, and training. On more than one […]

Categories

- Accounting (1)

- Donation (1)

- Donation Matters (1)

- Donors (2)

- Nonprofit Accounting (7)

- Nonprofit Advice (5)

- Nonprofit Best Practices (5)

- Small Business Accounting (2)

- Small Business Advice (1)

- Uncategorized (3)

Gallery

About Author

Nam eget dui. Etiam rhoncus. Maecenas tempus, tellus eget condimentum rhoncus, sem quam semper libero, Aliquam lorem ante, dapibus in

Recent Posts

- Are You Guilty of Tax Evasion?March 21, 2016

- Did you hire Chicken Little? 3 Things to look for in an outsourced accountantMarch 11, 2016

- Is a Home Office Right For You?February 25, 2016

- Are You Guilty of Tax Evasion?